Rags to Riches

by Unknown

Ever since businesses has jumped on social media platforms to take advantage of marketing, it has all skyrocketed for many. But is this worth all the hassle? So many companies nowadays have engaged with Facebook, Twitter, Instagram - the list is endless. In this post I will be talking about how MasterCard moved from danger to brand building opportunity through enterprise 2.0 technologies and the return on investment on this project. But firstly, what is ROI?

Return On Investment - ROI

ROI is the most common profitability ratio used to evaluate the efficiency of an investment. (Investopedia, 2012) The most frequently used method to determine ROI lies in the formula above, dividing net profit by total assets where it is expressed as a percentage or ratio. Easy right?

Conversation Suite - Priceless

Throughout the world, MasterCard processes payments between the banks of merchants and the card issuing banks of the consumers who use the cards to make purchases ever since 1966. ( MasterCard, n.d. ) Basically helping you and me online shop.

MasterCard realised the potential of social media usage in the workplace as a security threat to the organisation five years ago. Managers and employees in the financial services sector also had an impression that they were not allowed to mention the company on their personal social medias as it was a public company and fear of inadvertently sharing confidential details. As the employee demographics of the company grew younger and the company slowly accepted that regardless of age or generational cohort, that they were all digital citizens.

MasterCard's Adaptation to Socia Media

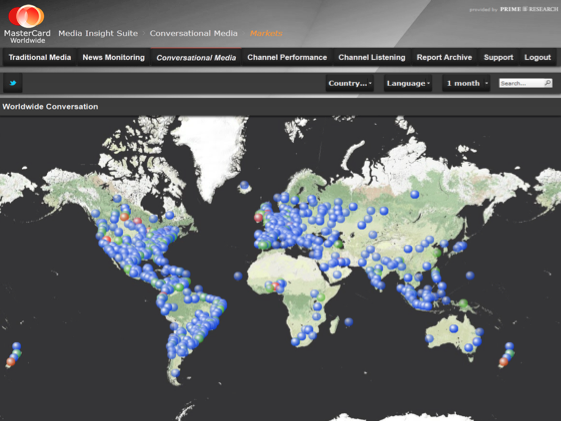

From there, MasterCard CEO transformed the entire company from a business to business financial services company to a payments technology company that is consumer focused. (Cameron, 2013) MasterCard combined social and digital media so that each employee was also a brand ambassador. With their launch of the Conversation Suite - a social media program to keep track of conversations about the brand, it is also aimed to educate, empower and encourage all MasterCard employees to become successful brand ambassadors. (Meister, 2014)

$$$

The Conversation Suite was created over a six month period including 18 months of updates after the launch.

Note: these numbers are only based on assumption

- During this six month period, MasterCard outsourced their market research to a company named Prime Research

- This market research was conducted on approximately 40 million people where the data gained through emailing 200 costing $3000

- Therefore giving the investment cost a total of $600 000 000 by 40 000 000 / 200 x $3000

- McKinsey's analysis of 250+ engagements over 5 years with companies focusing on data with marketing and sales decisions also improves their marketing ROI by 15% to 20%. The annual marketing spend is estimated at $1 trillion therefore, it might have cost MasterCard a bit more for the Conversation Suite.

Watch the video here.

Through creating such an innovative suite, many benefits come along with it. Here, I will talk about the tangible and intangible benefits and the many strengths and weaknesses that may impact on the company.

Intangible Benefits:

MasterCard created a sense of employee loyalty as they are all considered brand ambassadors. This is an advantage where 100% to 150% of an annual salary to replace middle level employees ($75 000 per year). (Goldschein & Bhasin, 2011) The average turnover in financial services of 18% costs an employer with 100 employees $1 million per year.

Gives MasterCard access and the ability to interact with people talking about the brand which gives them an insight on the customer's wants and needs. However, this may take time and money out of the budget to keep a team of people speaking directly with the public.

Intangible Benefits:

MasterCard created a sense of employee loyalty as they are all considered brand ambassadors. This is an advantage where 100% to 150% of an annual salary to replace middle level employees ($75 000 per year). (Goldschein & Bhasin, 2011) The average turnover in financial services of 18% costs an employer with 100 employees $1 million per year.

- MasterCard has 8500 middle level employees therefore costing 85 million per year. A decrease of 5% turnover sees a net gain of $25 million per year due to brand/employee loyalty.

Gives MasterCard access and the ability to interact with people talking about the brand which gives them an insight on the customer's wants and needs. However, this may take time and money out of the budget to keep a team of people speaking directly with the public.

- Focus groups cost $50 per person where Conversation Suite can talk directly with up to 40 million people. (Lee, 2002)

- Gain = 50 x 40 mil = $2 billion

MasterCard transformed a security threat into increased brand awareness where they eliminated the chance of confidential information of being exposed to the public and minimising litigation costs. This is a weakness as the company is in need of a team of brand ambassadors which can be costly.

- It is assumed that 50 employees can cost a company a loss of $65 000 by wasting time on social media (Goldschein & Bhasin, 2011) However, MasterCard trained all of their employees into Brand Ambassadors to be involved with the Conversation Suite.

- Gain = 8500 / 50 x 6500 = 11 mil + litigation costs

Allows MasterCard to gauge new developments with the public through Paypass. This gives the ability to be more competitive in the global market knowing what each region wants specifically.

- With the use of Conversation Suite, it directly leads to MasterCard being able to gain public insight to Paypass before the launch, tweaking it to meet consumer demands.

- ROI = ((2000 + 25 + 11) - 600 / 600) x 100

- That equals a 230% ROI a year, continuing to increase over the years.

References

Gordon, J., & Spillecke, D. (n.d.). McKinsey on Marketing & Sales. McKinsey on Marketing & Sales. Retrieved September 22, 2014, from http://mckinseyonmarketingandsales.com/

Lee, M. (2002, September 30). Conducting Surveys and Focus Groups. Entrepreneur. Retrieved September 16, 2014, from http://www.entrepreneur.com/article/55680

Meister, J. (2014, March 26). Social Media: Moving From Danger To Brand Building Opportunity. Forbes. Retrieved September 24, 2014, from http://www.forbes.com/sites/jeannemeister/2014/03/26/social-media-moving-from-danger-to-brand-building-opportunity/

Lee, M. (2002, September 30). Conducting Surveys and Focus Groups. Entrepreneur. Retrieved September 16, 2014, from http://www.entrepreneur.com/article/55680

Meister, J. (2014, March 26). Social Media: Moving From Danger To Brand Building Opportunity. Forbes. Retrieved September 24, 2014, from http://www.forbes.com/sites/jeannemeister/2014/03/26/social-media-moving-from-danger-to-brand-building-opportunity/

Hi Michelle, this is the first time I have stumbled across your blog. I mist say, I love the professional image you have constructed with your layout. In terms of the ROI, well done!

ReplyDeleteI had always considered employee loyalty a key intangible benefit but never thought to put a value on it through replacement costs. I suppose that the saved expense from replacing employees is not the only benefit that would be derived from increased loyalty. Once empowered, employees could potentially boost their productivity and innovation due to added confidence and purpose. This could also prompt a boost in revenue or cost savings for the company.

Keep up the good work!

Hey Dee, thanks for your amazing feedback :-) I agree, MasterCard is so clever with these things. Maybe that's why they're such a successful company!

DeleteWill check out your blog as well :-)

Hey Michelle, that was a really informative post. I think the Conversation Suite is a really unique and innovate way to involve the employees of MasterCard and social media is a productive way.

ReplyDeleteI agree, I don't think I've heard about any other company doing something similar to this :-)

DeleteHi Michelle, I enjoyed reading your blog post. Great work! It is interesting to see how in the past, social media was a threat for companies, where their information or practices could leak or harm them, and now, big companies and the ones in the Financial sector, are realising how important and beneficial social technologies can actually be.

ReplyDeletePlease if you have the time stop by my blog as well. I did my ROI analysis about a hotel in Vegas. Thank you. http://karenmendozasm.blogspot.com.au/

Hi Karen, thank you for your feedback it really means a lot :-) I agree, I think that big companies are turning social media into something so great and original. Will check out your blog as well :-)

DeleteThis comment has been removed by the author.

ReplyDeleteThis comment has been removed by the author.

DeleteOh wow thank you! I didn't even notice that silly mistake. I corrected it to 2 billion :-)

DeleteGreat to hear that Mastercard Roi is doing well. Really interesting, how you've mentioned that they used Conversation Suite as a social media program to keep track of conversations about the brand

ReplyDeletePlease if you have the time stop by my blog as well. I did my ROI analysis about a Cisco. http://leetranenterprise.blogspot.com.au/

Thanks for commenting and your feedback, Lee :~) Yeah, I definitely think it's a unique way to keep track of what's trending about their brand. I will check out your blog as well :-)

DeleteHi Michelle, great blog, I was very engaged while reading this! And you also seem to have done a lot of research for this as well, going by all of those references and the high standard that this blog is at. Great job!

ReplyDeleteI don't think I've heard of Conversion Suite as well, it definitely seems like it works though, seeing as Mastercard has done well with their ROI after utilising it. I was looking at Cisco's use of Salesforce Radian6. Have you heard of that? If you have, how do you think it compares to Conversion Suite?